What is Ceyron?

Ceyron is a decentralized exchange system that seeks to improve the liquidity of cryptographic assets more transparent and secure than the core counterparts currently in the market. Ceyron is an ecosystem built and operated by a network of popular partners around the world in a centralized network. The goal is to provide a globally appropriate financial experience with the power of Blockchain technology. Ceyron has a simple and sustainable transaction-based business model. Every trader benefits from the transaction.

Investment objectives and strategies

The investment objective of the IMF is to provide attractive returns on invested capital through an exclusive quantitative approach to underwriting credit assets, granted by Colombus Investment Management Ltd. The fund will follow the investment strategy based on science data. Nonparametric statistical models are applied to the expected profit problem in financial investment.

The net profit earned by the Fund is likely to be reinvested, but some of the most important benefits from the CEY token, whereby the dividends are approved by the board of directors and shareholders of the CFL shareholders.

Identify the problem

The problem Ceyron wants to solve is summarized below.

therefore Low Bank Rate The

economy of Africa is highly liquidated and has a very good financial footprint. Less than 10% of adults have bank accounts. The market returns with cash transactions. For example, more than 85% of trade is cash.

A highly competitive market

The mobile money environment in Africa is increasingly competitive. This enhanced competition means that consumers have more choices.

Very Low Usage Rates

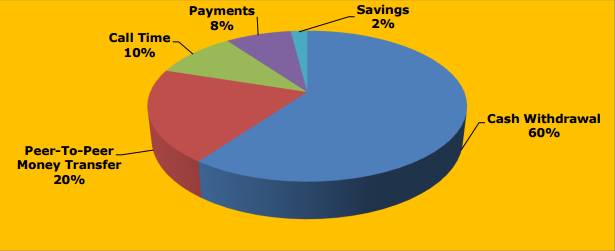

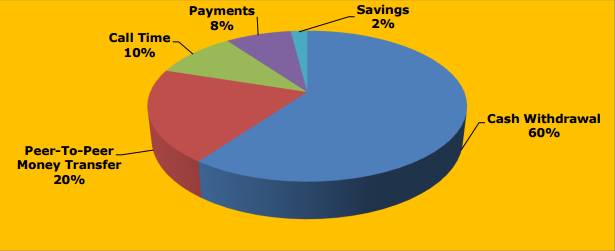

In the world, 12% of the account holders are in Africa. However, the level of inclusion in the financial system is very low. The behavioral analysis of the average paying user is similar to the general trend: the payment is equal to at least 60% of the transaction volume; Peer-to-peer transactions 20%; 10% call duration, 8% payment and 2% savings.

economy of Africa is highly liquidated and has a very good financial footprint. Less than 10% of adults have bank accounts. The market returns with cash transactions. For example, more than 85% of trade is cash.

A highly competitive market

The mobile money environment in Africa is increasingly competitive. This enhanced competition means that consumers have more choices.

Very Low Usage Rates

In the world, 12% of the account holders are in Africa. However, the level of inclusion in the financial system is very low. The behavioral analysis of the average paying user is similar to the general trend: the payment is equal to at least 60% of the transaction volume; Peer-to-peer transactions 20%; 10% call duration, 8% payment and 2% savings.

Use of low debit cards.

Prepaid debit cards are used for POS purchases and services (rarely). The owner of the CEY symbol, however, has the privilege of receiving an annual dividend on a CFL card.

Lack of credit that is safe and precarious for credit applicants.

In Africa, most applicants lack credit. CFL wants to solve this. More specifically, the CEY can be considered as a source of income distributed to entrepreneurs because it deserves credit.

Lack of stable and sustainable income for credit applicants

In Africa, loan applications have a stable and sustainable income deficit. With all this clear what the problem is.

CFL Solutions

CFL Credit Portfolio Fund, Colombus Investment Management Ltd. The main assets are credit assets obtained from non-banks. Assets, mortgages, second mortgages, real estate bridging loans, car loans, equipment and leasing loans, commercial real estate loans, asset-based loans and factoring factories comprise contracts. Non-bank financial institutions make loans and, in general, maintain all service skills. The IMF will, from time to time, obtain a loan in the pool, in a separate loan or in the equity interest in the loan. Typically, the billing and billing functionality is very creative for credit card recipients as the primary provider of transferring resources, including a special service obligation to fulfill the loan so far to provide and repay. Credit function other than the services provided by the creator, the secondary "backup" officer gets engaged.

This ensures that cash payments and repayment of credit assets continue. Currently, 60 percent of mortgage loans in the US are held by banks of up to 30 percent (30 percent) by 2013. This is done on a bank loan platform by hundreds of US $ trillion banks alone on US mortgages. The fund management platform for handling debt and risk payments and the origin of credit profiles, origin, volume, warranty, Duration and regulatory compliance costs are responsible for definitions of quality management and to confirm the quality of service. Fund Managers, the highest performing assets on the platform, will be assigned to liquidate the CFL portfolio for high risk assets from both the voters and the CFL portfolio. The solution that Jeyran brings here

Easy and fast

You can send Ceyron as an e-mail. Where there is no place to live, Ceyron can send and receive.

Decentralized

We use a decentralized blockchain technology, so no reliable third parties exist. Transactions are made directly between users.

Ceyron are not limited only would generate $ 250 million. For this reason, prices rise when demand is high and the amount of funds remaining does not increase.

* Recommended Jeyran solution for this problem

It's worth it.

* From the moment you win CEY, the world is open to you.

Ceyron changed.

* The Private Ceyron Exchange Site lets you buy and sell CEY and other crypto.

Travel expenses

Life without mortar. Your card is always considered a local currency and you get the perfect interbank rate.

anonymous

Everyone can operate their wallets and act with the same anonymity as Bitcoin.

Easy Money Transfer

Like Bitcoin, you can send anything you want, wherever you want.

No barriers

Send and receive international payments without participation.

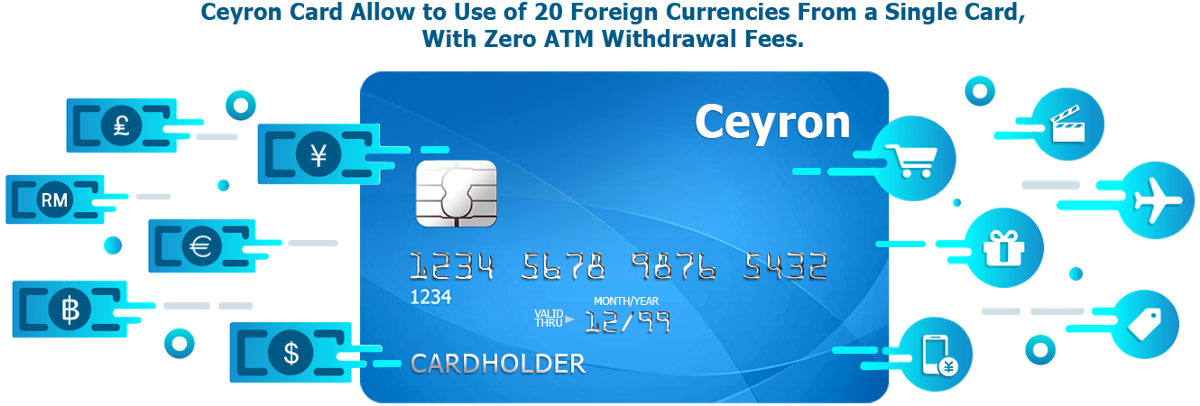

Ceyron Kart

The CEY Card is a physical, virtual and paid MasterCard card with a mobile application that lets you use twenty (20) foreign currency from a single card. In similar lifestyle card markets, most cards charge a percentage of the market price of a foreign currency distribution in addition to transaction costs. Customers traveling with more than one country will surely have to enter the Cash Exchange Fee and the Cost of a Currency Transaction. This cost is largely a process plus flat rate, the sector's main wage is 2.75% - 2.99%.

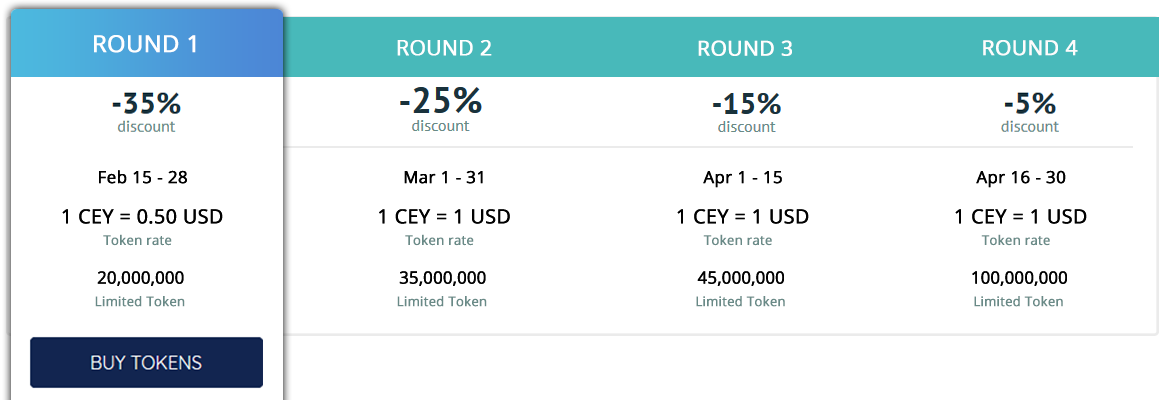

Sales and Distribution Token Ceyron (Cey)

The CEI symbol is a functional intelligent contract in the Fund. The CEY symbol is not returned. The CEY symbol is not for speculative investment. Future performance or value will not be promised or granted in connection with CEI Documents, including no pledge of natural value, no promise to continue payment, and there is no guarantee that the CEI Document is of special value. CEY rights are not securities and they do not join the Company. The CEY symbol is not entitled to any rights in the company.

CEI stock is a digital marker that will be non-voting stock class in Ceyron. The Loyal Agency & Trust Corp ("LATC" or "Candidate") for the iconic owner, and marketers will have a useful interest in Ceyron Finance Ltd. not included in the management or operation of the Fund or Fund Manager described below.

CEY Token - offers smart CEE's non-voting shares to be performed by Loyal Agency & Trust Corp., which is held by the possession of the CEY Token.

Some Information;

Token Name: Ceyron

Token: CEY

Price: USD 1.00 per CEY Token

Number of Tokens Sold: 250,000,000

Pre-ICO Sales Start: 16.2.18

Pre-ICO End: 15.3.18

Pre-ICO Discount: 30%, 25%, 15%

ICO Start: 3/16/18

Soft Cap: TBA

Hard Cap: TBA

Token Sales Results: When Cap Hard is reached

Accepted Currency: BTC, ETH, LTC and USD

Roadmap

First Quarter 2011 - Create a secure loan portfolio with funds; Expand the plans and capabilities of the CEY Debit Card, integrate strategic partner Debit Card with CEY Debit Card, and expand the capabilities of local debate cards, including crypto wallets; Hire integrated engineers to create crypto exchange and Bank Card features. The launch of the CEY Debit Card Program, which CEY plans to open approximately fifteen thousand (15,000) to twenty thousand (20,000) cards worldwide.

Quarter 2019 - Complete the exchange of crypto exchange and add cross exchange trading capabilities, raise the markers listed on the stock exchange to other ERC20 markers, and complete the integration of these exchange platforms well into their debit cards.

Quarter 2020 - Create decentralized apps to meet complex banking needs, such as smart contracts, to facilitate sales tax payments in the sales terminal.

Quarter 2019 - Complete the exchange of crypto exchange and add cross exchange trading capabilities, raise the markers listed on the stock exchange to other ERC20 markers, and complete the integration of these exchange platforms well into their debit cards.

Quarter 2020 - Create decentralized apps to meet complex banking needs, such as smart contracts, to facilitate sales tax payments in the sales terminal.

FOR MORE INFORMATION VISIT LINKS BELOW

Website: https://ceyron.io/

Telegram: https://t.me/joinchat/HlFUXhLIUYQL88_NtoM4sA

Facebook: https://www.facebook.com/Ceyron/

Linkedin: https://www.linkedin.com/in/haythem96/

Twitter: https://twitter.com/cryronico

Instegram: https://www.instagram.com/cryronico/

Author: Tejo_surty

No comments:

Post a Comment